GIL Summer 2018 Update

Even when gold ran to $1,370 in early April, gold mining stocks were trading like garbage. Many of us were baffled at what was going on. Aren’t the mining stocks supposed to lead the metals? Well, yes they are and they still do! Apparently the gold/silver shares were trading poorly because they were forecasting a weaker gold/silver price…what a concept!What has definitely been missing with these gold runs above $1,300 is gold stock sector strength. However, I believe that conditions are already showcasing this phenomenon subtly but quite clearly. We are in for a phase where gold/silver equities show marked strength versus the metals prices and there finally is evidence that it is beginning now. First, let’s look at Gold itself…

As you can see gold is very oversold with a 22 RSI on the daily chart as of July 2nd. However, both seasonality and the COT (commitment of traders report) lay out a very likely rally from here.

Another visual on seasonality over the past 20 years:

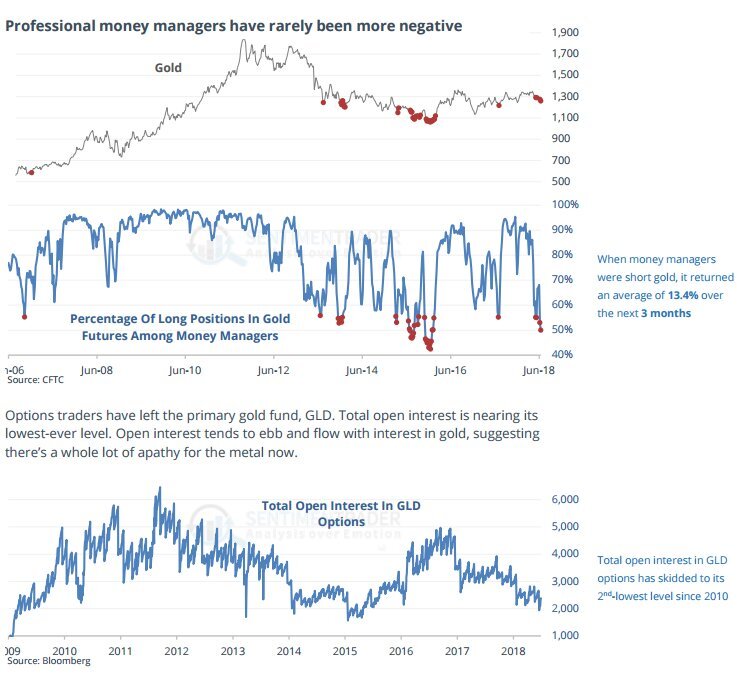

Here’s a tweet from Fred Hickey on June 29th, commenting on the seasonality chart:“Best day of summer to buy gold (b4 seasonal rally), DSI index at just 8 -lowest since Dec 2016 (b4 big gold rally). Last Friday's COT: Managed Money net spec long futures lowest since Jan. '16 (b4 gold/gold stock explosion higher). Spec short increase highest in at least 10 yrs”Then a follow on tweet after the COT report was released:“Gold rally setup's even better with just released COT report. Another 12K short futures contracts added, bringing 2-week total short increase to 46K -a stunning 63% jump. Large spec net longs down close to early July 2017 level - from where $140oz gold rally began on 7/7/17.”When open long interest by money managers turns to levels in the next photo, the average return has been 13% over the next 3 months. Total open interest in GLD by options traders is nearly its lowest reading ever.

The Hulbert sentiment index also has an extreme reading with gold market exposure among market timers at minus 13. This is a tremendous set up for a gold rally!

Certainly these are widely known resources to gauge the gold market but the most striking signal has come from an unlikely place. The premium over melt value on rare/semi rare gold coins from the late 19th and early 20th century are currently near zero!! Meaning, the markups on these are about the same as modern coins, which is a rare phenomenon. In 2011 for example, premiums on these exact coins were over 100%!This is actually a big opportunity for those of us that hold modern gold coins. I would strongly suggest contacting your dealers to find out the cost to send in your newer coins and receive a similar amount of St Gauden or Double Eagles from the early 1900’s/late 1800’s. If it’s a nominal fee, which some investors are reporting. There is no doubt that these coins will trade at significant premiums once again in a strong bull run in gold. This is a rare and huge opportunity for those that want to take action. At minimum, if you don’t want to send your coins in for a trade, buy some of these semi rare coins outright at these levels.When the market presents an opportunity to buy gold coins from 1877 at the same price as going minted in 2018, you do it! This speaks volumes to the bearish, dead, hated, and ignored gold market which is a very bullish sign from a sentiment standpoint.

Gold Stocks

How about the gold stocks? Well I’ll leave you with one chart and that is the GDX:GOLD action below:

Not only is this a big breakout from cup and handle formation last Friday, we’re about to see a “golden cross” this week, which is another bullish technical pattern.Listen, this data is very important and points a myriad of fingers towards a pending gold rally, led by gold stocks. But my best indicator is just to look around! You know many of these companies/stocks and see where they are trading….it’s incredible! I feel like we have been the frog in boiling water for 2 years that have been desensitized to just hot bad/hot it has actually gotten.I also say that gold trading around and recently above $1,300 an ounce USD in the face of a record stock market, rising dollar, rising real estate, rising technology stocks, rising crypto currencies, rising rates, and everything else going on….is actually showing incredible strength! Wait until the circumstances set up an environment where gold has tailwinds instead of constant headwinds in the global markets.If we see a normal rally from the conditions outlined above, we’ll see many of our junior gold/silver stocks double by December. 30-50% on large and mid cap producers will be very normal. And that will be just normalizing! Things are extreme on the bearish side right now so I am an active buyer of physical gold, physical silver, gold and silver juniors, and gold/silver producers. When the stocks outperform the metal, we saw how strong they can be during the first half of 2016. I expect something in between a similar move and half that move which would still be extremely profitable in percentage terms (GDX/GDXJ tripled in that timeframe).Don’t lose your resolve now gold/silver investors! This is a time to be vigilant active buyers bot sitting around crying in your coffee. Or even worse…..ambiguous!

For updates on unique ideas on individual mining stocks, please sign up for our free newsletter below.