GIL Fall Review

Gold: Its Role in the World and History

It is time to start thinking big. I am going to lay out some compelling data in an attempt to stretch your time horizon as it pertains to the enormous opportunity in front of us via a renewed bull market in gold. A small consortium of you will both get it AND be able to take action (in many cases once the bets are made—inaction) to make the big money from what is staring us in the face. I waited for the Fed before diving into this intro so as to set the tone about what is next in the very short term. That was actually my mistake and exactly what I talking about in terms of mentality (I’m guilty of this from time to time as well—this piece is an exercise for myself to do the right things) that is short term in nature.

The short term remains fuzzy as GDXJ and the sector has not retained decisively its 50 day moving average. I’m going to lay out some interesting charts, as well as data on volatility that can clearly mentally prepare you for making a lot of money in gold related bets going forward. I believe owning physical gold itself is the safest place to park money in the world, in any asset class, including fiat (paper) cash. The store of value over millennia is unquestionable. It is a proven place to park hard earned money and ensure it keeps it's worth, versus when it’s done in cash in any paper currency. The dilution of the global central banks that print money to devalue their currencies, and stimulate “growth”, affects each and every one of us. It is subtle, which is why and how they get away with it.

I often use the example of the cost of buying a “quality” men’s suit almost one hundred years ago (let’s use 1929, which was ending the roaring 20’s) and today. How many dollars did it cost at that time to buy the nice suit? Using a general calculator and what I found online, the cost was somewhere between $29-45 for a quality suit (a decent one could be bought for $20-29). The same suit at that time could be purchase for one ounce of gold (we know the price was set in the early 1930’s at $35 an ounce). Today, the same ONE ounce of gold can buy you a high quality suit ($1,300), maintaining its purchasing power over almost a century. To the contrary, if we use $35 in USD terms for the suit, you need to cough up 37 times more dollars ($1,300 divided by $35) today. Why? Because of monetary dilution by our central bank. Back then, there was at least a link to gold in terms of how much paper currency could be printed. President Nixon clipped the last tie to gold in 1971 and the acceleration of dollar printed has been exponential to this day, eroding our dollars purchasing power considerably. What would you have had your cash exposure in between the early-id 1970’s and today…dollars or gold? The gold price has increased 37 fold against the USD, while the dollar has eroded in purchasing power to the tune of needing $8 or so 2016 dollars to $1 in 1970. Gold got ahead of itself in 1980 and it does so from time to time, just like it gets way too cheap at times. But, over long stretches (decades), it keeps its consistent value in the world.

This is walking through why gold is so important (and its cousin Silver—which has commanded monetary value at various times in history as well) because it is CASH. It is a CURRENCY and it is the BEST one available to us at this time. Gold actually is an inverse reflection of the currency you view it in. It bottomed out and actually rose aggressively in Rubles, Yen, and Brazilian Real well before we saw the rise begin in dollars this last January. Gold is a global currency and dramatically protected investors that have the bulk of their earnings wealth in the 3 currencies above over the past 3-4 years, if they put some of it into gold before their currencies wilted in value.

I wanted to simply walk through a basic thesis about the store of value and importance in gold in general in this issue. At virtually all times (except when there is a bubble….which is coming in gold and mining stocks) it is appropriate for everyone to have a percentage of precious metals in your portfolio for protection, insurance, and in certain times…growth. Now is one of those times that we can capture all 3. With the world in the state it is in, I believe investors should have a bare minimum of 10% of your investable assets in physical gold and gold related instruments. I have about 65%. And that % for me at some point in the future will decrease to 5-10% because I am NOT a gold bug, I am simply a gold BULL at this time.

I don’t believe that doom is always around the corner and that we need it to make money in gold. In fact, gold has proven that it can rise right alongside stocks, as we recently witnessed from 2002-2007. Additionally, anyone that thinks rising rates is a death knell to the gold prices is gravely mistaken. We only need to go back to the last rising rate cycle in the 1970’s to the very early 1980’s where we saw gold and rates peak together. Perhaps initially rising rates will cause a gold correction, but it is the real rates that matter most, not nominal rates. And, we will see rates/gold rising again in the future again…just wait and watch. In fact, we may have already started seeing it as of this month in September 2016, it is the case so far.

Time to Stretch Your Horizon if you want to get Rich

I want to address what I see over and over as what I feel is the biggest shortcoming of my subscribers. It is the backdrop and foundational worldview that can correct the second biggest mistake I see, which is buying and selling at the exact wrong times (sell low-buy high) based on emotion. We will negate much of that activity if you buy into what I’m about to show you. If you are bullish on gold like myself and believe that we are in a new bull cycle, you likely feel one of two ways. Either the top in 2011 was the end of a secular cycle and this is a new start or like I believe, that this is simply a continuation of the secular bull market that began in early 2001 when gold was trading less than $300 an ounce (USD).This why it is going to be necessary, I believe, to stretch out our timeline when viewing this asset class and the performance to come. Gold went up 12 straight years! From 2000 to 2012, gold rose year on year every time. That is a VERY strong bull market and perhaps unprecedented (I have not found another asset class up 12 years running without a break). Now, a 3 year breather after 12 years higher does not seem like such a big deal, does it? In fact, I would say it is rather healthy if this is indeed a massive secular bull market that will end up lasting 20-30 years in time (very likely and possible). If one of your stocks went up 12 days straight, then digested gains by pulling back fairly hard for 3 days, would you call 911? No. This action in gold/silver is normal and they are inherently very volatile markets!You must understand and accept this fact or you will either lose money, make very little on small trades, or miss the biggest opportunity in my lifetime entirely. When gold mining stocks pull back 20-30% over the last couple of months, after tripling to going up 6/7X since January, I marvel at emails I get asking about the condition of certain companies due to the retracement. Hello?! What do you expect? That prices will go straight to the moon with no shakeouts, consolidations, or pull backs? If gold is destined to go to, say $2,500 an ounce, you better get your head screwed on straight if you want to reap the 10-20-50-even 100 baggers that I plan on having in this newsletter. We earn those investment gains by sitting though periods like this, which is actually quite minor so far in terms of time or severity (there will be much worse before the top). If you can’t handle this little pull back in your portfolio, you may want to reconsider playing in this sand box at all.

Drawdowns Are Necessary

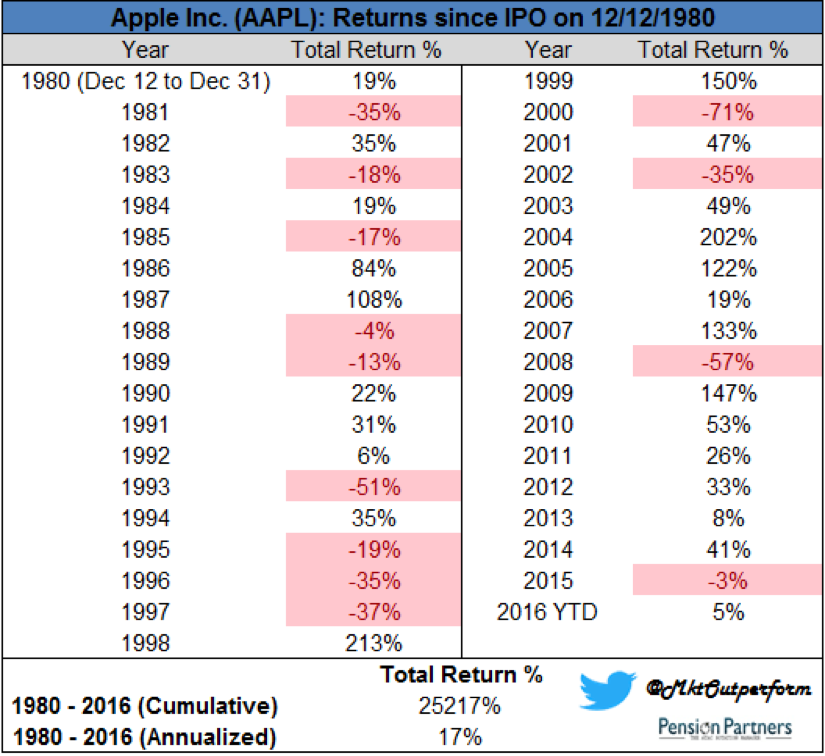

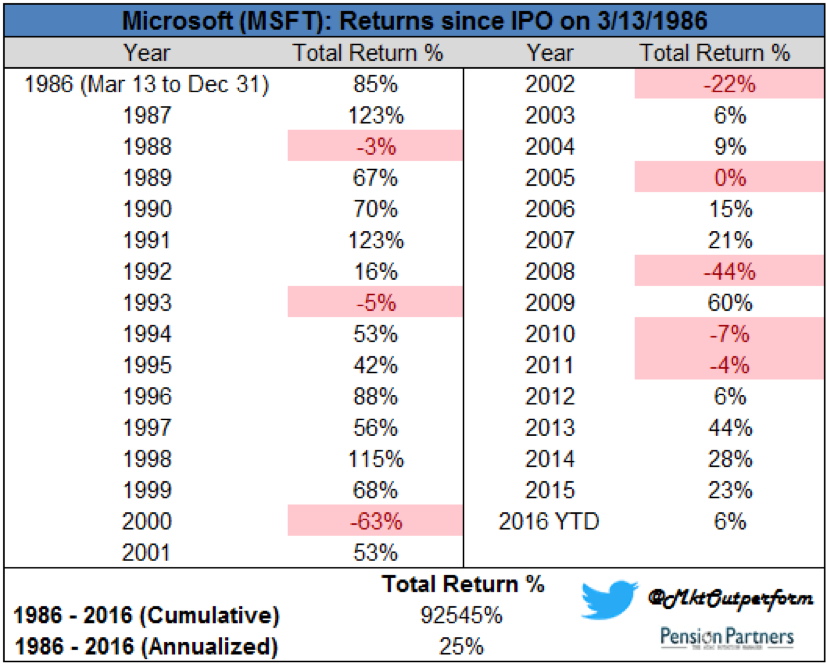

In Charles Billelo’s from Pension Partners recent report “Big Winners and Big Drawdowns” we see the facts behind some of the largest wealth creating stocks over the past 40 years. Below are some excerpts to consider and in each case below there were some very scary and even crushing drawdowns in these stalwarts.Apple, Amazon, Microsoft and Alphabet...

All among the largest and most revered companies in the world.

All have returned unfathomable amounts to their shareholders.

All have experienced periods of tremendous adversity with large drawdowns.

When thinking about big winners in the stock market, adversity and large drawdowns probably aren’t the first words that come to mind. We tend to put the final outcome (big long-term gains) on a pedestal and ignore the grit and moxie required to achieve that outcome.

But moxie is the key to long-term investing success, for there is no such thing as a big long-term winner without enduring a big drawdown along the way…Apple has gained 25,217% since its IPO in 1980, an annualized return of 17%.Incredible gains, but these are just numbers, masking the immense pain one would have endured over time.

Apple investors from the IPO would experience two separate 82% drawdowns, one from 1991 to 1997 and another from 2000 to 2003.

Amazon has gained 38,882% from its IPO in 1997, an annualized return of over 36%. To put that in perspective, a $100,000 investment in 1997 would be worth just under $39 million today.Breathtaking gains, but they were not realized without significant adversity. In December 1999, the initial $100,000 investment would have grown to $5.4 million. By September 2001, less than 2 years later, this $5.4 million would shrink down to $304,000, a 94% drawdown. It took over 8 years, until October 2009, for Amazon to finally recover from this drawdown to move to new highs.

Bill Gates is the richest man in the world, having amassed his $80 billion fortune as the founder of Microsoft.

Microsoft has returned 25% a year over the past 30 years, a remarkable feat.

The path to riches in Microsoft looks deceptively easy on the surface. The calendar year returns from its IPO in 1986 through 1999 were incredibly high and consistent, masking significant underlying volatility. In 1987 Microsoft advanced 123% but would suffer more than 50% decline in October during the stock market crash. It would not recoup those losses for two years, until October 1989. Its largest drawdown in history occurred over a 10 year period, a 70% decline from 1999 through 2009.

It should be clear from these four examples that large drawdowns are an inevitable part of achieving high returns. If you haven’t yet experienced such a gut-wrenching decline, then you probably haven’t owned something that has appreciated 10x, 20x or more. Or you simply haven’t been investing for that long.I know what you’re thinking. There has to be a better way. You want that big juicy return but without the big drawdown. Yes indeed, as does everyone else.The problem, of course, is in trying to hedge or time your exposure to big winners, you will likely miss out on a substantial portion of the gains. Or your emotions will cause you to sell at precisely the worst time (after a large drawdown). Your volatility and drawdown profile may be lower, but that tradeoff will come at a price. As I wrote earlier this year (see “The Hedge Fund Myth”) the price for hedge fund investors seeking lower volatility/drawdown in equities has not been a small one, with the HFRX Equity Hedge Index (an investable index of Long/Short equity funds) posting a negative return since 2005 while the S&P 500 has more than doubled.

Many investors in these funds were seeking the Holy Grail, a high return (often 15-20% in their “mandates”) with little risk (no large drawdowns). They expected their managers to pick the Apples and Amazons of the investment world without incurring the inherent volatility that comes along with it. As we know, that is a complete and utter fantasy.

All big winners have big drawdowns. Accepting this fact can go a long way toward controlling your emotions during periods of adversity and becoming a better investor.

**Back to Eric:

Do you know who always thinks short term? Poor people. Because they usually eat hand to mouth so it is very difficult to plan long term. I’ve been there but I also have worked hard mentally to stretch my horizon and think like a rich person with plenty of resources. I remember when I was a rookie stockbroker in 1995/1996 and I put a pitch together to open new accounts with Apple (AAPL).

This was right before they brought Steve Jobs back in 1997 to run the company after he was ousted by the board for a period of time. I liked the brand and felt like it was a classic turnaround story with plenty of potential in a growing computerized world. I had barely any clients back then but I pitched it for a solid couple/few months in the low teens per share. I opened a handful of new accounts and got each of my clients involved. The share price vacillated over the next 6-12 months not doing much. I got impatient and sold out for a “hot play” that came up.

Now, at that time, it was impossible to see the future of Ipods, Ipads, Iphones, and Itunes. But, what if I would have just kept my head down getting clients to invest in this company over years, buying more during big market or company specific corrections. In 15 years, I would probably have dozens if not hundreds of centi-millionaires ($100MM) and have huge wealth myself without all of the stresses of chasing returns. I’m not saying never trade. I still to this day enjoy trading/speculating.However, with core investment positions, it is best to plan on not touching them for a long time. Wealth gets created by investing early in a bull cycle and sitting until it matures, which simply takes time. The only strategy in this regard I do recommend considering is to take your principal risk out of the investments by selling half at a double or 1/3 at a triple (more appropriate in this gold bull). If you can have the discipline to then buy more in your positions during extreme drawdowns, a fortune can be amassed. But I have news for you, “scalping” a penny stock for a 20-50% gain here or there will not get you anywhere. Investors dramatically tend to hold their losers too long and sell winners too early. In fact, averaging up is for pros, down for amateurs, is a saying on Wall Street.The fact is that we have no idea just how high some of these gold stocks can go. You may even want to consider carving out a percentage of your holdings to only sell in terms of time not price. We may think MUX can go to $10 or $20 per share and even have one of those prices as a goal to sell some. But what if it ends up going to $100-$200 per share? I’m telling you…it can and might happen. But the key there will be time. It’s not going to $100 in a year or two but in 4-7 years? Maybe so. Think of Apple and the examples above….who knew in 1995??

Why is it Up/Down?

I will be walking through individual company updates shortly but I think this stuff is important. One of my pet peeves in investing and capital markets is that people are always obsessed with finding a reason behind a movement in a particular market/stock. For example, if you held MUX from my report in May 2015 buying in around a buck. It hits $5 a year later then falls back to $3.50 and you email me “what is going on with MUX? It keeps going down”. I feel like slapping people for these questions sometimes I’m sorry! Obviously, if a stock breaks off from the sector and plummets on news, there is a reason for it.

But in the case above and what is the case 90% of the time, is that stocks go up and down! That’s what they do. Literally, 90% of the cause in any stocks movement/direction is due to the state of the overall market and in particular the sector it trades in. That last 10, maybe 15%, is company specific and that’s where we create an edge in performance by isolating that portion. Individual company news can clearly determine short term movement, but over time sectors move in unison.

A classic investing book that I highly recommend is Reminiscences of a Stock Operator (link here) about the greatest trader of the first half of the 20th century, Jesse Livermore.

Livermore got the nickname “boy plunger” because he would read ticker tapes in brokerage houses and “plunge” into trades with serious conviction, usually making money. His story is fascinating and one of huge highs/lows but some of the lessons have endured the test of time. One of my favorites, and one that guides my outlook considerably to this day, is an example he mentioned at several stages, as to drive home the point. I believe it may be the single most valuable thing that I have ever learned in my professional investing career.

Jesse told of various times that he would go into the office of an old codger, a wily veteran of the stock market, and ask “why” a particular stock was going up or down. Each time, the wise man would say “well, it IS a bull market you know. Or, well it IS a bear market”. This can be clearly understood if we just look at the mining stocks and gold’s performance from 2010-present. In 2010 well into 2011, gold was absolutely still in a screaming bull market. But once the bear stepped in during the fall of 2011 (the same time I launched this newsletter!), every single stock in the sector started to roll over, and hit lower lows over the ensuing 4 years.

I would receive emails about companies like Timberline Resources or Patriot Gold etc where the investor would lambast management for the declines. Or ask what is going on at these companies because the stock keeps going lower. In the back of my head or in my direct answer…..well it IS a bear market! What is so important as I type tonight, is to send the message to you all that we are in a new bull market in gold, silver, and mining stocks and it will not stop for years. Abrupt and sometimes violent pull backs will be followed by fresh runs to new highs, continually frustrating those that got shaken out at exactly the wrong time

.I have a crystal ball. It’s a little hazy in the sense that I can’t see how the zigs/zags will go exactly, but I am VERY confident that gold will hit new all time highs before this is said and done. Minimally, you can make bets based on a retest of the 2011 highs around $1,900 an ounce. I showed back in March, which I was waiting for, how the sector busted up through its long term weekly trend line, proclaiming a new cyclical bull cycle. But, I will point out now that we have one last hurdle to overcome before the gold bull market begins to roar like nothing you have ever heard before. It is the 10 year, monthly trend line. Do you want to “see” why gold is having a tough time right now at these levels?

The chart below goes back ten years. This is actually an enormous tsunami of a flagging pattern that has been building energy for 5 years. Once it bursts, I believe we could start seeing the precious metals begin blowing people away with further strength. The mining stocks have been on an absolute tear this year, but gold hasn’t really shown any chutzpah. But it will baby…oh it will! And we better be positioned ahead of it beforehand, or have to chase prices like the rest of those catching on because of the headlines.

We need to see the price of gold close on a monthly basis at least once between $1,375-$1,400 (ideally $1,400). This is the last step to unequivocally know that the multi year uptrend has begun in earnest. Until then, there is still a slight chance the price rolls over in the channel again, bottoming around $1,000 an ounce. However, I believe that chance is very slim at this point, somewhere in the 10-15% possibility range.

Is it Too Late to Get In?

If for some reason you do not own any or much in terms of precious metals or mining stocks, it is absolutely not too late to do so. The risk will remain being OUT of this sector versus IN it. I really liked Thomas Kaplan’s reply at the Precious Metals Summit about 10 days ago when asked what he would do if looking at the sector fresh and if it was too late after the recent surge in mining stock prices. “Keep buying” he said without hesitation. Obviously, we need to be wise with entry points and accumulate on pull backs (like now) but we are NOWHERE near the ultimate highs we will see in this space.

Nobody owns this sector on Wall Street or Main Street! Most investors either hate it, don’t understand it, or don’t care about it. The strong stock market has actually been nice cover for the stealth surge we’ve seen in gold this year. As far as the current correction in the miners it’s not clear what is next. After a historic run up that we saw in the first 7 months of the year, a rule of thumb would be to reasonably expect a corrective phase lasting 40% of the time of the rally. That would take it into early November to resume the uptrend. It’s less than 6 weeks away now so I’m not all that concerned either way. But if you are truly on board with the view that gold is going a lot higher in the coming years, you should welcome these corrections to buy more miners. This is especially true if you aren’t even positioned meaningfully! Where is your head at right now? Are you skittish? Reading this review is a chance to rethink your goals and beliefs as it pertains to gold and what you want to do.

The daily chart on GDXJ (Junior Miners ETF) below is mixed. It did bust above the triangle pattern and closed above it for two sessions (I like to see 3 for confirmation) but then dropped back into the walls on Friday. A concern is that we are trading below the 50 day moving average. I would not be surprised to see this break either up or down this week. But, we should have some clarity soon

For perspective sake, let’s look at the ten year chart on the gold miners below. As you can see, we are a FAR way away from 2011 highs. The sector almost tripled since January lows but needs to more than triple to get back to the highs. I firmly believe that in this cycle, the gold miners will break out into new highs, alongside the price of gold. There are less companies for money to flow into and there is less gold coming out of the ground due to the ravaging of the past 5 year downturn. The global monetary state of affairs is a powder keg of drivers to want to own gold and we will see $100 an ounce daily gains in the price within 3-5 years I believe.

In summary …

Stretch your time horizon to allow for massive long term gains versus short term piker profits.

Expect big drawdowns in the future on the road to those gains.

Lock in principal risk when a stock doubles or triples so you have no monetary or emotional ties during a big correction.

Make sure that you have at least 10% of your assets in gold related investments.

Get in the habit of buying low and selling high—don’t wait to chase with crowds.

Be patient. Give at least part of your holdings 5 years to see what happens in time.

New IdeasFolks, if you want to full spectrum of action, you should be a premium member. Actions taken now will determine how fruitful the future higher prices in gold will be for you. We have lots of ideas that don’t make it to free members including several we’ve sold completely for huge profits. Others, in the silver arena, won’t be shared in our free newsletter. You can sign up via the subscribe page if interested

.I’ll also be publishing very soon my new top 5 juniors to buy now. This will be a spin-off of our top ten report from late last year which has killed it. Some of those ideas have been removed and new plays have stormed to the forefront. You’ll want to get these ideas early and you can at least get a few of them via being a premium member. A couple may be reserved for whomever wants to buy the report first, so they can have a chance to add a couple of new positions before anyone else. Those will probably be released in chunks of 10 people at a time every few days so as to not disturb market pricing very much.

That’s it for our Fall Review! I hope you enjoyed it and I’m excited to see what gold and the miners decide to do next!

Obviously, I am long in virtually every stock/company mentioned in this report and may buy or sell at any time and without notice to subscribers.

For unique ideas on individual mining stocks, please sign up for our free newsletter below.