Blog

Crypto or Junior Miners—Who Wins in 2021?

A Glimpse into My Past is Revealing the Future

Elite and Premium members have been privy to the core message below as of late (although not the old broker stories!). I have dripped over and over and often straight up pounded the table to encourage GIL subscribers to accumulate Bitcoin and Ethereum for quite awhile. Besides making my first recommendation here at GIL to buy BTC in 2016 at $500 ish, we have had a clear strategy since the spring of 2018 (when BTC broke down into the $7,000's) to start building a serious position for the next bull run, which is clearly in motion!

Owning some bitcoin into the late 2017 run to $20k was nice, but it was funny money! I sold around $2,500 and announced that publicly here in our e-letter, right before it RIPPED to almost $20K in just a few months! I bought back in between $8,700-$9,500 and was able to flip it fast in the mid $17,000's near the peak. Although it was again, small dough. But during that summer of 2017 I had begun a deeper dive into bitcoin, blockchain, and cryptocurrencies in general. The price action into January 2018 caused me to accelerate my learning. That is primarily because of the memories it stirred up from when I was a young stockbroker during the internet stock bubble in late 1999-early 2000.

Back then was the first time in my life that I had ever made any "real" money, and it came fast and furious! Not just in transaction fees, but my client accounts and mine had gone up between 8X to 15X in a matter of 5 months! I actually felt deeply compelled to write down the account values of my top ten people in early October 1999 before leaving for a trip. This was done on the back of my business card and taped to my wall! I felt like I "knew" that the lows were in and that something big was on the horizon. They were not large accounts, but these were the faithful few who had followed me to a new firm about a year earlier in November 1998.

During the 2nd half of 1999, a prevailing concern was the "year 2000" issue, which predicted utter chaos as software in various sectors weren't programmed to go past 1999 (including the banks-apparently!). However, I had formed a contrarian viewpoint and it was cemented when I heard economist Ed Yardeni say that he was expecting a melt up in early 2000, not a melt down in stock markets, as was the prevailing consensus. I thought that the hype and fear around imminent disaster was over baked into the market, while the internet names were subtly being accumulated by smart money.

Fear and Crickets to MANIA in a Blink of an Eye

*This is all very relevant to gold and our mining stock investments which I get into below.

The entire year from October 1998 until November 1999, I had focused on making sure that somebody (anybody!) bought shares in my favorite stock at the time, ALPNET! I chipped away day in and out to build our position in AILP and some days I didn't get anyone to take action. Other days, I was able to get a small new account with the pitch or have a client buy $2k worth (our firm minimum). My close customers knew that I had serious conviction though, and added shares periodically between $1.50-$1.80 during the 2nd half of 1999. I was making a big bet on Alpnet, just like I had done 2 years earlier in a company called Modacad, which became a career making bet and lifesaving home run!

Then between the middle of November 1999 and February 2000 (not even 100 days), Alpnet's share price went from 1.50 to $10.50! Not only that, but I was zeroed in on the action, convincing the majority of my clients to top up when we saw the stock finally break $2 on volume, which had been formidable resistance for a long time. I then had everyone sell half of their positions right around $6 per share, which was still in December, if I recall. Then, "they" shook the trees on the late comers piling in on pure momentum and AILP pulled back abruptly to $4. But I saw further gains coming, and support firming, so we went all back in again at $4-$4.20!

4-5 weeks later a fund manager was recommending it on CNBC and AILP traded over 10 million shares and hit $10.50 exactly! Notably, I was the only buyer in sight on MANY days over the previous 12-18 months. I began cashing everyone in on about 2/3 of our positions between $9-$10 on the CNBC highs that same day. Fast forward to March 2000 when the highs were being put in on the NASDAQ, and I started buying AILP back around $7. I was looking to duplicate the magic I had from selling at $6, buying back in at $4, then basically calling the top to the day. Not to mention that I was proven right after a very long stretch as a lone buyer in the wilderness! The internet hype was still in the air and many of us were caught up in the HIGH of making so much money so quickly.

Now fast forward 18 months later to late 2001 (well into a nasty recession) and Alpnet was acquired for just .21 cents, while I bought it all the way back down! We gave virtually ALL of it back. And when I say "all" that includes most of the other enormous trades and gains we had between Q4 1999 into Q2 2000. I picked many fast 30-40-50% winning trades along with multiple triples, quadruples, and even more 8-10X hits. What an experience now that I think back!

The lessons I learned during that time were Invaluable, but I was burnt out and completely broke by early 2002. I was also flipped upside down in 2009 at the absolute worst time! Forced to puke out of my positions at the lows so I could pay my bills and eat! This was also an expensive but very valuable lesson. I've had to learn the hard way many times during my investing and trading career. But these cumulative errors and setbacks are exactly why I have a very formidable toolbox to utilize today. So, why did I just walk through a 1999-2000 cautionary tale during the internet boom? Because...It is about to happen AGAIN, are YOU ready for it?!

I believe that the largest creation and transfer of wealth in human history has begun!

2021---Gold and Especially Bitcoin Will Pounce

Whether you like it or not gold investors, some BIG money has already started to wade into bitcoin under the "digital gold" premise. I personally see these two assets as perfect partners! Together they are and will eat up fiat currency market share globally. But sadly, most gold bugs (I am a gold BULL and don't wish to get stepped on like a bug after this bull market ends!) either hate bitcoin or blow it off entirely, which is NOT a good idea! Most bitcoin loyalists say that bitcoin is the "better version" of gold and that it will "Capture X or Y market share from gold". The majority of gold investors do not understand bitcoin at all and the majority of crypto investors do not understand gold at all! Yet BOTH assets will attract massive amounts of capital and savings globally at an accelerated pace moving forward.

It is my contention and strong belief that gains in Bitcoin will continue to SMASH every other asset class that exists over the next 5-10 years (just as it has done over the last 1-5-10 years). This includes gold and silver. The only shot that "our" sector has to keep up with 100%-500% annual gains are via very select junior gold and silver mining stocks. Gold is simply not designed to blast off like bitcoin, nor would I want it to be! Gold is already at an extremely mature stage and commands a massive market value worth over $11 Trillion USD. BTC is only $350 Billion, which is less than approximately 20 individual companies value today. BTC has more room to gain in % terms by far but that means it will have to TRIPLE against every 10% bump in the gold price!

In terms of gold, silver, and mining sector investments, 90% of YOU are underweight. How about the rest of the investors out there that don't even understand it?! We still have less than a 1% global allocation to gold, which is ridiculous. If you have been a subscriber here for a while and still own no physical gold or silver, and have a "play money" allocation into mining shares, I don't know what to tell you! For the rest of us, we've got this area covered in our sleep, and it is going to be a very fun 2021 and beyond! But the crypto area is where I am very concerned that our readers will finally be taking time to learn more about it and buy into the sector when Bitcoin is in the hundreds of thousands per, or in the millions (which is just a matter of time!).

But those of us who have TAKEN ACTION early on are now about to see our spoils accelerate Madly! I have put in close to 5,000 hours studying AND using crypto and blockchain technology over the past 3 years (give or take 1,000 hours). 1/2 of this time was put in during 2020, and yes I am behind on sleep! This fervor was driven by the huge mistake that I made in the early 2000's, as the internet was rising up and about to become such a disruptive and integral to all of our lives. I focused on making quick money trading and investing in "hot stocks" whose business model descriptions included "buzzwords" like e-commerce, bandwidth, web browsers, ISP's, online marketing, SEO, banner ads, and many more.

The error I made was not putting in the work, time, and energy to dig beneath the surface and understand JUST HOW MASSIVE things were about to change! Those who did, are VERY rich now. Even if you sold vacuum cleaners back in 2002, if you were early to start Google/Internet search advertising, you would be the largest vacuum distributor in the world!

URGENCY

Once $20,000 BTC breaks, watch what happens. SEE YA! A massive amount of institutional capital will be jolted into hyper alert mode to BUY MORE and FAST. The problem is that there is NO FLOAT. Bitcoin is VERY scarce. I"m observing a myriad of signs and signals that having over 40% of my entire net worth in Crypto at this time is absolutely merited! That's right, 40%. Some of the smartest money that I know who come from old school backgrounds in traditional capital markets, venture capital, and macro investing, are 50-80% in crypto! I'm sorry all, but $hit is about to get WILD!

I believe that we are HOURS to maybe DAYS away from Bitcoin trading above $20,000 and blowing wide open! It is VERY close, hence this long write up tonight, because I am WATCHING it about to happen...

Your Options

I am convinced that Bitcoin will be trading 4x to 10x higher than it is today, within 12 months. If I'm even marginally close on those projections, it means that it is not too late! In fact, I can tell you that I am strongly convinced that it is still early, but the tipping point is imminent.

Now what? Well, you best be buying some Bitcoin and Ethereum at a minimum! If you want more important alerts and updates as this market SOARS in 2021, it would be foolish not to join GIL Premium. The price is doubling in 2 weeks as well and I am likely shutting down new membership sometime in Q1. The Elite waiting list should be considered quickly also if you are a high net worth individual, family office, or professional investor of any sort. Premium is paramount and WAY too cheap! Both or either memberships can be secured here:

If you want to play catch up FAST (even just on the education of this incredible movement), or are already involved but want to add octane to your BTC/ETH holdings positions, go grab one of my crypto special reports that I just put out last week:

Don't worry too much about the prices, they are peanuts compared to what you get and what's coming! People who purchase the Tier 3 package (up to 10 max) will have direct access to me via text and my cell number. I'm sharing extra time right now so that you can get moving! I want to help ensure (at least for the next 2-4 weeks) that those who step up now will be able to facilitate what you want to buy quickly. Even if it's just to get started, open up a crypto based account, and have your US Dollars or Euros etc on the ready to buy once Bitcoin busts $20k. By the way, I will be plunging in the last of my purchases when that occurs!

Decentralized Finance, or "DeFi"as it's commonly known, is about to turn every single corner of our financial system on its head. I know it's coming because it is already here! I'm using various platforms to generate over 5% interest on some of my Bitcoin and Ethereum holdings. I am getting over 8% interest on US Dollar savings! It's real, and there are many other opportunities to accrue very attractive rates in some of the most exciting companies/coins around. Gold, silver, and mining stocks are actually quite an integral beneficiary of this current and future financial paradigm shift. There are abundant investments to deploy capital in this/our sector alone. So, I will not cover any crypto tokens, coins, etc. outside of Bitcoin here in the GIL E-Letter.

It's important to note that you do not have to buy an entire Bitcoin for $19,200 (currently). The blockchain was brilliantly designed to break down as small as one-hundred millionth of a Bitcoin, called a "Satoshi". This means you that can put $5, $50, or $200 into it. You can use Paypal, Cash App, Coinbase (if US based), and I love Binance.com if you live anywhere outside of the US for Bitcoin purchases and hundreds of various Alt coins if you wish. Here is a link to receive 10% kickbacks on any/all commissions that you pay for life:

I will highlight this sector once we burst through $20k because it will be immensely important for us as gold investors, opportunists, and traders alike. But, outside of BTC, you will need to be on the Tier 2 or Tier 3 crypto report list, an elite member, or at least a premium member to receive more content on these matters.

Lastly, I do not recommend GBTC as a viable supplement for your exposure to Bitcoin! You're going to pay a 25% premium to NAV because you're lazy? Open an account and buy Cryptocurrency! It isn't going away. Blockchain stocks are not the same as owning Bitcoin or Ethereum etc either. Yes, we own several o them with huge upside, but none of them are "miners". Why pay their capex, opex, exchange listing fees, and management salaries to mine exactly what I can easily buy directly myself!

And whatever you do next, please PAY ATTENTION and spend time LEARNING because EVERYTHING is about to change! The internet, mobile, social media, and many other enormous value creations that changed our world have NOTHING on what is coming. Now is not the time to be asleep...

If you like this content be sure to enter your email into the box for free E-letter updates.

Real Vision: Why Gold Miners? Why Now?

Roger Hirst is joined by Eric Muschinski, CEO and Founder of Gold Investment Letter, to talk about why now could be an exciting time to invest in gold miners. Whilst much of the world has been in lockdown, financial markets have continued to operate, often with spectacular results. Why Gold Miners? Why Now? And how to play it.

Market Report on Gold, Gold Miners, and Uranium

Gold Miners

On a technical note, GDX, GDXJ, and SIL (silver miners), put in a bearish "doji" yesterday on the daily charts. The "wick" that you can clearly see, most times indicates we've hit a temporary top in the larger gold and silver miners. I don't expect much of a pullback, but if you're looking to buy into producers that you missed much cheaper, you may get a slight discount from here over the next week or two. Even if the general stock market takes another dive, as I'm betting on, this time the gold stocks will not go down nearly as much as they did in March, in my view.

That said, I am noticing organic and real rising bids in a good chunk of the smallest gold junior miners!! In my "2020 Random Predictions" report I stated this: --"Junior gold/silver miners see significant capital inflows above $1,700 gold". Well, we are definitely not seeing any "significant" capital flows yet in tiny junior exploration stocks (I'm talking about sub $50M market cap type small). However, we're seeing bids, and share prices moving steadily off of bottoms, which is a start. Is it THE start? We'll find out soon.

Just one example I noticed yesterday is Bravada Gold (BVA/BGAVF), in which I own personally over 10% of the issued/outstanding shares and warrants, closed at .09-.10 bid. This is up from nearly dead volume in March when it touched back down to .05. There has been no news, but companies like this that have put tens of millions of dollars into exploration work over almost 2 decades, are trading for peanuts. At a dime CDN, this company with a 1m oz gold resource at their Wind Mountain project, and another 10 properties in Nevada (a handful are very attractive gold prospects), has a $4.5m USD market cap. I do not know the exact paid in capital amount since inception, but I'm confident in saying it's over $25M put to work on their various projects, if not double that amount. If you look into the details of their assets versus valuation, it's stupid.

This nano cap junior part of the market is absolutely the cheapest and riskiest part of the mining sector, and they are also ultimately going to rise the most in value as well! The organic bids in more than a dozen names I watch appearing, sometimes in earnest over this past week, is encouraging. Once actual real capital trickles down to this "ghetto" of the sector, incredible moves will occur. This is due to the backdrop of gold being in a pristine position to flourish in price, in all currencies, even against the almighty US dollar.

USD/Gold

That said, in the very near term, there is some compelling arguments for another potential rush into USD. Ultimately, and I'm talking intermediate and long term, the US dollar will be, and is being, debased. A surge in USD to $110-120 via another huge leg down in stocks and/or rush to cash, would be cataclysmic for emerging markets and dollar denominated debt globally. There is no way the US can allow too strong of a dollar for any extended period of time, it will wreak HAVOC!

Americans are so lucky that our POS fiat currency is still the globes reserve currency and viewed as the predominant flight to safety when it comes to cash. Yes, it is the strongest fiat on the block. But what happens when inflation, apparently no longer possible according to many "academics", starts to explode on the back end of this brrrrrrrrrr printing press? The currency of last resort is GOLD. It is the true measure of money, and the US dollar will BOW to it in terms of price, and in terms of IMAGE in the coming years. Traditional asset managers and institutions are out to lunch here and have some likely rude awakenings coming their way. Allocations in gold remain minuscule, but this is beginning to change.

So, in the short term, yes I have a strong chunk of USD that I am sitting on and it may get even stronger in the near term. But, the safest store of value of wealth over the coming 1-3 year time frame, let's say, is Gold. In fact, I have been quite conservative, I feel, in my views on ultimate price targets for gold's secular bull market. I always say that if we see $2,500-$3,000 gold, we are going to make utter fortunes in our mining shares, which I still believe.

I've used $3,000 an ounce as a modest target because if you take just HALF of the bottom to top percentage move in the 1970's, golds last major secular bull market, we would get a price of $3,200 USD (up from just under $300 in 2001). Based on what I'm seeing on MANY levels, I'm officially raising my forecast to $5,000-$6,500 per ounce gold. I believe that we will hit the $2,500-$3,000 level within 6 to 15 months on the outset. $2,300/$2,400 is likely by January 2021, if not sooner (which is just 8 months away). A retest is a "given" in terms of the 2011 highs at $1,900 and change and it will be interesting to see how long and how many attempts are needed to break it.

I believe it will take 2 attempts max, and do so within a quarter (maybe 2) of the first test. Once gold breaks through $2,000, which is only 15% away(!!!), we will swiftly begin entering a period of mass institutional and retail FOMO (fear of missing out). The frustrating activity from 2012 all the way until last year before it finally broke $1,400, will be a distant memory. Ray Dalio, Paul Tudor Jones, Peter Thiel, Raoul Pal, Paul Singer, Stanley Druckenmiller, and another dozen of the most successful prominent billionaire investors I could list agree with me. These guys are early, they are not late to a party! Who doesn't find gold at least intriguing in this environment? Warren Buffet, Wall Street sheep, and people who do not understand its function, that's about it.

So, I hope for the sake of you that are STILL (Hello???) underweight gold, silver, and mining stocks, that we see a near term pullback/pause. I've had a long term accumulate/buy up to price on gold to $1,600 for years, based on there being at least 100% upside from there ($3,000-$3,200). I'm raising that to $1,800 for those with no gold position. Don't wait for a pullback if you're naked! At least get something on the books. Then if/when we get a sharp snap back, be ready to buy more. The same with gold mining stocks, which are very likely the most compelling sector in terms of valuation and future earnings growth power on planet earth right now!!!

Q1 2020 earnings season will be the start of big money realizing how good gold producers profits are going to be moving forward. It will be a small early taste, but I expect significant exceeding of expectations by the majority of gold producers this Q1 earnings season. Show me ONE analyst that modeled in an average gold selling price of $1,600 for Q1! That's up from about $1,470 in Q4 and $1,325 on year over year comps. This gold price environment, including now a massive discount on one of their largest costs (energy), for a sector that has had to continually tighten their belts for 7 years, is going to be extraordinary for cash flow growth and M&A activity!

Q1 earnings for so many industries are going to be disastrous, Q2 likely even worse. Once earnings start to flow in earnest shortly, with abysmal or removed forecasts, it's the trigger I feel will stop this dead cat bounce rally in major indexes. For gold companies however, it will be a completely different story.

Uranium

Another one of my random 2020 predictions was: --"Uranium stocks become hot again and are one of the best performing sectors in the market."

I believe we're just starting to see this coming true as the sector has seen a very powerful bounce off of the March lows (many doubling or more). Uranium prices have been rising steadily the past few weeks, up nearly 50% in short order. Supply has been shut down massively by several of the worlds largest producing mines and now the big catalyst for US uranium producers AND explorers is imminent:

Part of the reason I felt good about uranium stocks 4 months ago was because I had known this was coming since last fall. The Trump administration is going to make things VERY attractive for domestic companies to find and produce uranium. Valuations for certain US based uranium stocks could explode in the coming months and years. This sector has been on its back for a decade and is well overdue for a comeback.

I have one huge primary junior position in Encore Energy (EU/ENCUF), which recently put out a press release outlining very well the current state of affairs in the uranium market. I've posted that below, which also gets into details about their assets. This deal has an approximate $20m USD market cap at yesterdays closing price with nearly 50 million pounds of US based uranium resource (inferred and indicated). So, you can buy uranium in the ground at .40 per pound (spot price is $32 per LB on its way to at least $45-50, I believe) and get all of their other assets for free (huge land position, valuable data library, and mill).

This is primarily the same team that advanced Energy Metals Corp from penny stock to a $1.8 Billion exit at the peak of the last uranium bull cycle. The upside here is very large in my view and it finally looks like uranium is going to get some love from the market. Obviously you can move up the chain and get your exposure via Cameco (CCJ), or a mid tier listed company like Nexgen Energy (NXE), which I own as well.

Check out some of the stats in Encore's recent PR and keep an eye on this sector.

ENCORE ENERGY PROVIDES UPDATE ON MAJOR REDUCTIONS IN URANIUM SUPPLY

EnCore Energy Corp. has provided an update on material developments affecting the uranium market and its implications for the long-term outlook of the company's portfolio of significant U.S. uranium assets.

Highlights:

About 50% of world mine uranium production has been halted and the spot price of uranium has increased by +30% in less than a month;

EnCore is well positioned for rising prices with a portfolio of significant U.S. uranium projects, including ISR amenable Sandstone-hosted resources, and high-grade Breccia Pipe properties;

EnCore's management team has extensive experience in all phases of the nuclear fuel cycle;

EnCore has a healthy treasury and no debt.

As a result of the ongoing COVID-19 pandemic, seven of the world's ten largest uranium mines have been temporarily halted, representing approximately 50% of global mined supply. This major reduction in mine supply has resulted from halted operations in Kazakhstan, Namibia and South Africa while Cameco's Cigar Lake Mine in Canada has been placed on extended care and maintenance.

The ultimate extent of supply reductions has yet to be determined but is expected to be significant. With demand continuing at a steady rate, along with a reduction in mined supply, the Company anticipates significant declines in uranium inventories. This anticipated decline is likely to accelerate rising prices in order to incentivize new sources of production. We have seen early indications of this trend with prices for all forms of uranium and equivalents having increased substantially in recent weeks. The uranium spot price has increased by over 30% to US ~$32 per pound as of April 17, 2020 from US ~$24 per pound as of March 23, 2020.

The severity of current supply disruptions underscores the need for security of supply, a key driver behind President Trump's plan to establish a strategic domestic uranium reserve (See News Release dated February 19, 2020). The Company is encouraged by the President's initial actions to reinvigorate the domestic nuclear industry along with his continued emphasis on removing unnecessary regulations and improving access to critical minerals on federal land.

EnCore Energy's Significant U.S. Uranium Portfolio

The Company is well positioned for higher prices with a portfolio of significant U.S. uranium projects. The portfolio is highlighted by advanced-stage Crownpoint and Hosta Butte ISR projects, which hosts Indicated Mineral Resources of 26.6 million pounds contained within 12.7 million tons grading 0.11% eU308 and Inferred Mineral Resources of 6.1 million pounds contained within 2.8 million tons grading 0.11% eU308(2). Importantly, Crownpoint is permitted under a Nuclear Regulatory Commission License to recover up to 3 million pounds per year.

The Company's Marquez Project, a past-producing underground mine within the Grants Mineral Belt of New Mexico, hosts another large uranium endowment. A 2010 NI 43-101 Technical Report documented Measured and Indicated Mineral Resources of 9.1 million pounds contained within 3.6 million tons grading 0.13% eU308, an Inferred Mineral Resource of 4.9 million pounds contained within 2.2 million tons grading 0.11% eU308 at the project.*

Equally significant, the Company holds a dominant land position within Northern Arizona, the highest-grade uranium district in the U.S. with an average recovered grade of over 0.60% U308, and located within trucking distance to the only operating uranium mill in the U.S. The Company holds more than 80% of all current mineral claims within this district with 467 claims that together with state mineral leases span more than 10,000 acres.

An innovative targeting approach using an airborne Versatile Time Domain Electromagnetic (VTEM) survey provided an exploration approach for evaluating the district as a whole and resulted in 145 validated targets within the Company's land package. A total of nine targets have since been drilled with eight having intersected significant mineralization, an 89% success ratio.

As reported by the U.S. Geological Survey, Northern Arizona Breccia Pipes are an important source of uranium from both an economic and national security perspective. Increasing access to this large, high-grade uranium endowment, which is now subjected to a temporary withdrawal dating from Obama Administration, is consistent with President Trump's stated goal of increasing access to critical minerals on Federal lands while at the same time reinvigorating the domestic uranium mining industry.

In addition to a strong portfolio of properties, the Company also controls a leading U.S. proprietary database. The most recent additions are the Quaterra (Metamin U.S.) and the VANE Minerals (US) LLC files with emphasis on the northern Arizona Breccia Pipe District. This vast data collection includes the Union Carbide worldwide database, the UV Industries database, the W. R. Grace uranium related files, Uranium files from Federal Resources, Ranchers Exploration uranium files (Hecla), select Atlas files, and a number of private collections and small partial collections from various companies.

The EnCore Team - A Proven Track Record in the Uranium Sector

The Company is led by a team of uranium experts with a proven ability to build value within the domestic uranium sector. The EnCore team was instrumental in advancing Energy Metals Corp. to compile the largest domestic uranium base in U.S. history before the company was acquired for $1.8 billion during the last major uranium bull market.

This experience has allowed the Company to opportunistically navigate the difficult post-Fukushima uranium market by selectively acquiring high-upside projects, maintaining low corporate expenditures and a healthy treasury, which currently stands at over $3 million in cash with no debt. The team views the ongoing supply disruptions, along with long-term increases in demand, as a bullish indicator for the uranium market and the need for higher prices to incentivize new supply sooner rather than later.

William M. Sheriff, the Executive Chairman of EnCore Energy, was a pioneer in the uranium renaissance as co-founder and Chairman of Energy Metals Corp. He was responsible for compiling the largest domestic uranium resource base in U.S. history before the company was acquired by Uranium One, where he continued to serve as a Director.

Dr. Dennis Stover, Chief Executive Officer, is a renowned uranium mining expert with a 40-year career focused on direct involvement with commercial uranium exploration, project development, and mining operations. Dr. Stover served as Chief Operating Officer for Energy Metals Corp. and then as Executive Vice President, Americas for Uranium One, Inc. where he oversaw commercial development of Uranium One's substantial U.S. uranium assets as well other uranium assets in the Americas.

Dr. Douglas Underhill, Chief Geologist, has 50 years of both domestic and international experience with natural resource exploration, development and analysis, including 40 years with a specific emphasis on uranium. For a decade, he served as the Uranium Resource and Production Specialist with the International Atomic Energy Agency.

Richard Cherry, Board Member and a veteran nuclear industry executive, has worked for leading companies in the areas of uranium mining, production, conversion, marketing and power generation operations for 40 years. Mr. Cherry previously served as President and CEO of Cotter Corporation and Nuclear Fuels Corporation, both affiliates of General Atomics Corporation, where he oversaw their mining and milling operations in Colorado.

Mark Pelizza, Board Member and environmental expert, has spent 40 years in the uranium industry that involved with numerous commercial U.S. ISR project. He was responsible for the permitting and licensing of the Church Rock, Crownpoint and Unit 1 projects in New Mexico. His licensing efforts led to the Company's Crownpoint project receiving an NRC license. He previously served as Sr. Vice President of Health, Safety and Environmental Affairs with Uranium Resources Inc.

Eugene Spiering, Geologist, has over 30 years of experience including 10 years focused on uranium in the U.S. Significantly, Mr. Spiering oversaw the application of VTEM aerial surveys to the Company's large land holdings in Northern Arizona and subsequent drilling that led to two new discoveries and revolutionized the exploration approach for this district, with an 89% success rate.

Gordon R. Peake, Director of Lands, previously served as Vice-President of Lands for Uranium One Americas, Inc. from 2007 to 2010 and with Energy Metals Corporation (US) from 2004 until 2007. He brings over 40 years of experience in natural resource exploration, development and production having worked with major and junior mining companies.

Nuclear Energy for the 21st Century

Nuclear power is an important part of the global energy mix and currently provides nearly 20% of all electricity generated in the U.S. and 55% of emission-free power, far more than wind and solar combined. With an increasing global recognition on the importance of reducing carbon emissions while at the same time meeting the growing requirements for 24/7 baseload power, nuclear power is essential for meeting both environmental and economic initiatives.

Ongoing global expansion, license extensions and new technological advancements are expanding long-term demand. Russia, China and India continue to be an area of rapid growth. These three nations collectively account more than 70% of all new construction. Even with China's large-scale nuclear buildout, nuclear is planned to meet only 4-5% of China's electricity demands. By comparison, the U.S. currently generates nearly 20%, indicating the potential for greater expansion of China's nuclear generating capacity.

The U.S. currently operates 96 nuclear power plants. In 2019 these plants generated a record 809 million megawatt-hours of electricity, the highest total since the birth of commercial nuclear power in 1957 while achieving a record-high 93 percent capacity. A total of 88 of the 96 reactors now have been granted operating life extensions from 40 to 60 years. In December 2019, the Nuclear Regulatory Commission granted the first-ever license extension to 80 years and subsequently again in March 2020. The continued lifespan of these reactors, combined with a world-class safety record, underscores the ability for long-life power generation and continued demand. Two new state-of-the-art reactors are also nearing completion in the state of Georgia.

New technological initiatives are providing new applications for nuclear power, improving the efficiency of existing operations, and incorporating additional safety measures. Several accident-tolerant fuel rods have been developed including Westinghouse's EnCore fuel rods, now adopted in commercial applications. Small modular reactors (SMR) are being rapidly advanced in the design and permitting phase for widescale use and are attractive due to lower capital costs and the ability to operate in a variety of locations. A number of other developments including modern reactor designs have the potential to further increase demand well into the future.

*I own shares of Bravada, Encore, and Nexgen and may buy or sell my shares anytime without notice.

GIL Summer 2018 Update

Even when gold ran to $1,370 in early April, gold mining stocks were trading like garbage. Many of us were baffled at what was going on. Aren’t the mining stocks supposed to lead the metals? Well, yes they are and they still do! Apparently the gold/silver shares were trading poorly because they were forecasting a weaker gold/silver price…what a concept!What has definitely been missing with these gold runs above $1,300 is gold stock sector strength. However, I believe that conditions are already showcasing this phenomenon subtly but quite clearly. We are in for a phase where gold/silver equities show marked strength versus the metals prices and there finally is evidence that it is beginning now. First, let’s look at Gold itself…

As you can see gold is very oversold with a 22 RSI on the daily chart as of July 2nd. However, both seasonality and the COT (commitment of traders report) lay out a very likely rally from here.

Another visual on seasonality over the past 20 years:

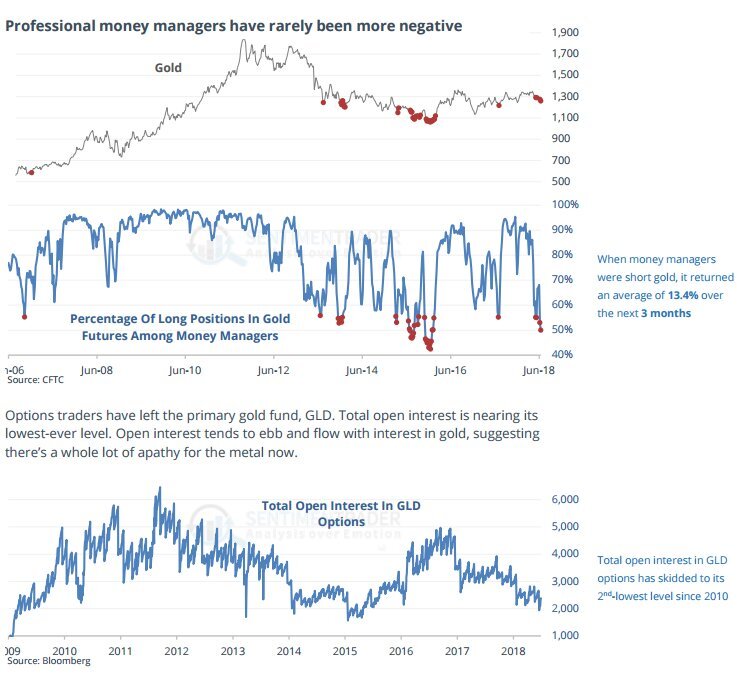

Here’s a tweet from Fred Hickey on June 29th, commenting on the seasonality chart:“Best day of summer to buy gold (b4 seasonal rally), DSI index at just 8 -lowest since Dec 2016 (b4 big gold rally). Last Friday's COT: Managed Money net spec long futures lowest since Jan. '16 (b4 gold/gold stock explosion higher). Spec short increase highest in at least 10 yrs”Then a follow on tweet after the COT report was released:“Gold rally setup's even better with just released COT report. Another 12K short futures contracts added, bringing 2-week total short increase to 46K -a stunning 63% jump. Large spec net longs down close to early July 2017 level - from where $140oz gold rally began on 7/7/17.”When open long interest by money managers turns to levels in the next photo, the average return has been 13% over the next 3 months. Total open interest in GLD by options traders is nearly its lowest reading ever.

The Hulbert sentiment index also has an extreme reading with gold market exposure among market timers at minus 13. This is a tremendous set up for a gold rally!

Certainly these are widely known resources to gauge the gold market but the most striking signal has come from an unlikely place. The premium over melt value on rare/semi rare gold coins from the late 19th and early 20th century are currently near zero!! Meaning, the markups on these are about the same as modern coins, which is a rare phenomenon. In 2011 for example, premiums on these exact coins were over 100%!This is actually a big opportunity for those of us that hold modern gold coins. I would strongly suggest contacting your dealers to find out the cost to send in your newer coins and receive a similar amount of St Gauden or Double Eagles from the early 1900’s/late 1800’s. If it’s a nominal fee, which some investors are reporting. There is no doubt that these coins will trade at significant premiums once again in a strong bull run in gold. This is a rare and huge opportunity for those that want to take action. At minimum, if you don’t want to send your coins in for a trade, buy some of these semi rare coins outright at these levels.When the market presents an opportunity to buy gold coins from 1877 at the same price as going minted in 2018, you do it! This speaks volumes to the bearish, dead, hated, and ignored gold market which is a very bullish sign from a sentiment standpoint.

Gold Stocks

How about the gold stocks? Well I’ll leave you with one chart and that is the GDX:GOLD action below:

Not only is this a big breakout from cup and handle formation last Friday, we’re about to see a “golden cross” this week, which is another bullish technical pattern.Listen, this data is very important and points a myriad of fingers towards a pending gold rally, led by gold stocks. But my best indicator is just to look around! You know many of these companies/stocks and see where they are trading….it’s incredible! I feel like we have been the frog in boiling water for 2 years that have been desensitized to just hot bad/hot it has actually gotten.I also say that gold trading around and recently above $1,300 an ounce USD in the face of a record stock market, rising dollar, rising real estate, rising technology stocks, rising crypto currencies, rising rates, and everything else going on….is actually showing incredible strength! Wait until the circumstances set up an environment where gold has tailwinds instead of constant headwinds in the global markets.If we see a normal rally from the conditions outlined above, we’ll see many of our junior gold/silver stocks double by December. 30-50% on large and mid cap producers will be very normal. And that will be just normalizing! Things are extreme on the bearish side right now so I am an active buyer of physical gold, physical silver, gold and silver juniors, and gold/silver producers. When the stocks outperform the metal, we saw how strong they can be during the first half of 2016. I expect something in between a similar move and half that move which would still be extremely profitable in percentage terms (GDX/GDXJ tripled in that timeframe).Don’t lose your resolve now gold/silver investors! This is a time to be vigilant active buyers bot sitting around crying in your coffee. Or even worse…..ambiguous!

For updates on unique ideas on individual mining stocks, please sign up for our free newsletter below.

Garibaldi and Metallis—The Big Score Part Deux?

Garibaldi Resources

So you want some action? Ok, we’re going to give you some action! Myself and GIL elite/premium investors have already been seeing quite a bit of action as we have been following the Garibaldi Resources (GGI/GGIFF) E&L Nickel Mountain situation since August. Amazingly, less than 90 days ago, GGI was trading for 17 cents per share and had been basing between pennies and 20 cents for 2 years! On Friday, it closed at $3.89 up over 20 FOLD in less than 30 months. The kicker here is that it is still very likely going much higher despite this massive short term run.Here is what we know from Garibaldi’s last press release:Highlights:

All 11 additional holes completed since EL-17-01 (see Sept. 1, 2017, news release) have returned broad sections of disseminated to blebby net-textured sulphides (pyrrhotite-pentlandite-chalcopyrite), hosted in olivine gabbro, consistent with a much larger-scale mineralizing event than ever previously suspected at Nickel Mountain.

X-ray fluorescence analysis of drill core supports the very high tenor of the sulphide at Nickel Mountain as previously disclosed by the company (photos of representative sulphide-bearing core from the new discovery zone are available for viewing at the company's website).

Assaying of drill core is being carried out by SGS in Vancouver and Garibaldi eagerly anticipates reporting initial results as they become available during the second half of this month.

Dr. Peter Lightfoot, an internationally recognized nickel sulphide expert and a technical adviser for Garibaldi, commented: "The host rocks at Nickel Mountain comprise a differentiated sequence of variable-textured and orbicular-textured gabbros and olivine gabbro with abundant disseminated interstitial sulphide. The exceptional tenor of the sulphide is a compelling feature of Nickel Mountain. “"When viewed in a global context," Dr. Lightfoot continued, "Nickel Mountain is a classic example of an intrusion produced by open system emplacement of silicate and sulphide magma through a dynamic magma tube within a differentiated gabbroic complex. This intrusion represents an open system magma highway along which successive batches of silicate and sulphide magma were emplaced."What does this all mean to us non geologists? That this nickel-copper sulphide rich ore body is rare, valuable, and likely massive! This whole situation is very reminiscent of the well documented unfolding of the Voisey Bay nickel discovery in the 1990’s by a small company called Diamond Fields. It is a straight up sin for any resource investor to not have read The Big Score by Jacquie McNish.In fact, those of us that have absorbed how Voisey Bay played out have realized that it probably isn’t wise to let go of our paper in GGI (or their neighbor Metallis Resources (MTS/MTLFF)-which I will focus on next) easily. The fact is that we have enough information already in my view to know that this is a special discovery. Most people wait for assays, 43-101’s, and more information to be released first but by then GGI will be higher and likely much higher than it is now. Speed is key in these situations and we are already seeing some big money taking swift action to secure stakes in GGI and Metallis (MTS/MTLFF).Falconbridge moved very fast to take a 10% stake in Diamond Fields/Voisey Bay early on, paying $108MM (over a billion dollar valuation) with zero 43-101 resource. Things moved so quickly that Diamond Fields stock went from pennies to $172 per share within 18 months before it was acquired by Inco for $4.5 Billion. When the ore body is real, and it is big, and it is rich, there is not necessarily a cap on how high it can go. There are already credible people that believe Garibaldi’s Nickel Mountain is bigger than Voisey Bay. Are they right? We’ll find out soon!

Sprott Takes Down a Stake

I met Eric Sprott last Friday at the Palisade Hard Asset Conference in Jekyll Island, Georgia. I greatly respect Eric primarily due to the fact that although “retired”, he is actively helping others in this business succeed. He is a valuable source of capital to junior resource companies with his personal cash, backing entrepreneurs dreams. Additionally, he spoke at the Palisade conference to support a couple of up and coming guys in this business. It’s very encouraging that Eric is still sharing his time and knowledge with younger guys like us that will be the next generation of junior mining financiers.I bring up ES because not only is he one of the most connected and successful investors that exist in this sector, but because he has been all over this discovery early and heavily. Plus, he is STILL BUYING shares of GGI and MTS in the open market. That is in addition to a seven figure private placement at 82 cents on GGI AND another $5 million he just put in at $3.15 in a $10MM financing (his piece just closed on Friday). He also just bought 400,000 shares in the open market at $3.75 on October 13th so for everyone that thinks you already missed this one, have you?!Keep in mind that the run thus far hasn’t even included assays on the most recent 12 holes, which are due this coming week. I expect GGI to confirm very high grade massive sulphide intersections as the photos of core on their website show:

http://www.garibaldiresources.com/s/Photo_Gallery.asp?ReportID=768260

Two drill rigs are still turning in the Golden Triangle camp, despite the onset of winter which can be brutal in this area. However, the company has a tiger by the tail here and seem to have the resolve to push through and continue drilling. At $4 per share, Garibaldi has a $330M market capitalization but if this is even half the value/scope of Voisey Bay, the price would have to hit $28 per share on a 50% of the $4.5B buyout comparison. We do not know if this is the case or not, nobody does yet. But it is good to realize now that this deal could have some serious legs. In fact, I am forecasting $7-8 per share by the end of November/early December as a next target , which is why I decided to write this up now to everyone.If correct, you can buy in, sell half at a double, and see what happens risk free after that. Eric made two key points about GGI/MTS at last week’s conference. First, that Nickel Mountain rocks are showing some similarities to Norilsk, not necessarily just Voisey Bay. Remember, Norilsk is/was even more valuable than Voisey Bay! If that’s the case, this could become one of the most valuable nickel-copper deposits in the world and is a once in a generation discovery. It seems that the rocks are showing a unique blend of similarities to both of these examples and some of its own unique properties as well.

Metallis Resources (MTS/MTLFF)

Dr Peter Lighfoot is a world renown expert on nickel sulphide deposits and is advising Garibaldi on this world class discovery. It seems his theory is that the ore body is actually a string of deposits, a “pearl necklace” of sorts. This part of Garibaldi’s last press release on drilling is telling to me: “While the nickel-copper-rich system remains open in all directions at Nickel Mountain, at least two kilometres of prospective ground exist to the east-southeast while a northeast trend of geophysical anomalies and surface mineralization continues for at least six km.”

This is important for those of us heavily invested in Metallis Resources whose Kirkham property borders Garibaldi just over 4 KM to the “southeast”. Essentially, GGI just confirmed that we are half way there, to the border at Kirkham. If the multiple deposit theory proves true and extends to Kirkham, Metallis shareholders could become very rich. I have 90% of my exposure to this play in Metallis, not Garibaldi, which I recommended to premium GIL readers initially at 25 cents in early August. Despite selling off a ¼ of my position around $1 to remove any principal risk, last week I bought all of those shares back and extra around $1.40 per share. I realized that this could be an opportunity of a lifetime and plunged back in last Thursday/Friday.Eric Sprott financed Metallis at $1.10 for 2 million shares just a couple of weeks ago. He has been buying in the open market regularly as high as $1.88 for 400,000 shares on October 13th (the stock closed at $1.45 on Friday). A hugely compelling fact is the tight and tiny share structure in Metallis which barely has a $30MM CDN market cap at $1.45 per share! The leverage here could be enormous and I believe that there is a pretty good chance that MTS can outperform GGI between now and the end of the year. How can that scenario happen?Metallis moved drill rigs to “Thunder North and Thunder South” a few weeks ago, which is near the border of Garibaldi. It is important to note that initially the company drilled a completely different part of their property testing a gold/copper prospect. Those drill results will be out first, perhaps in the next 2 weeks. But if drilling at Thunder North intersects massive nickel/copper sulphides similar to Nickel Mountain, MTS will fly. For example, if Metallis has one third of the resource along the same trend as Garibaldi, their market cap would almost quadruple from $30MM to $110M if Garibaldi stayed at these levels (again, GGI is currently trading at a $330 ish million market capitalization)Now, I believe GGI will run to $7-8 into/after their next batch of assays are released. MTS should hit $2.50-$3 just following GGI so that’s lmost a double as well. But if Metallis confirms high grade nickel/copper sulphides in November, their share price could trade to $5 easily, which would still only be a $100MM market cap. Metallis’ extremely attractive share structure just means that there is very little stock available in the float! Buyers will likely have to pay up, probably WAY up, in the coming months.For what it is worth I only asked Eric Sprott one question last Friday. “Do you believe the Nickel Mountain ore body extends into Kirkham?” His reply was “yes I do”. This is obvious just from his actions in the market but it was nice to hear it as well.

Risks To be crystal clear, there is still a lot of risk in both of these stocks. Even if Metallis is destined for $20 per share, there will be violent pull backs along the way and whip lash like volatility. That said, some circumstances warrant rolling the dice. I’m in a great position because I plan to sell the ¼ I bought back at $3 which will have given me a profit on what I put in as a total initially. Then, I’ll hold ¾ plus of my stake for free versus those of you that might just get in now around $1.50 on MTS. You may want to sell half at a double and let the rest roll if this thing plays out like I think it will. That way, you simply don’t have to sweat the gyrations and can give things time to unfold into 2018.There is a lot of smoke at Kirkham near the fire than is Nickel Mountain so there is better than a 50/50 chance that Metallis has some of this rich ore body on its property. However, the odds are likely less than 50/50 that they hit some of it with the first few drill holes! These are big properties so some patience may be needed and one thing that may slow this train down is old man winter.Just remember, it is new discoveries that drive junior resource share prices more than any other factor. Being early in a big discovery can make investors wealthy and that is why we play in this risky and cyclical arena. GGI and MTS guarantee ACTION in the coming days, weeks, and months. I do not think it’s too late to get involved but would encourage adding soon, at least entry sized positions then on any pullbacks. I would suggest adding MTS up to $1.75 and GGI to $4.50. If the gap around $1.21 gets filled on the MTS chart it would be time to back up the truck.Lastly, I would like to acknowledge the guys at Bull Market Run. They were definitely on top of this situation before anyone else and are the reason that I was tipped off early on. They do great work and have gone the extra mile in keeping investors updated!Make sure that you are signed up to our free list for updates on these stocks and other special situations…

For updates on Garibaldi and Metallis and unique ideas on individual mining stocks, please sign up for our free newsletter below.

Legal Disclaimer: I am offering ideas for your consideration and education. I am not offering financial advice. I am not a financial or investment advisor and am acting in the sole capacity of a newsletter writer. I am a fellow investor and trader sharing his thoughts for educational and informational purposes only. Garibaldi and Metallis is a paying sponsor of GIL so I have a conflict of interest. Do your own homework before acting on anything that I say. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided on the Website is based on careful research and sources that are believed to be accurate, Mr. Muschinski does not guarantee the accuracy or thoroughness of the data or information reported. The opinions published on the Website belong to Mr. Muschinski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Muschinski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published on the Website have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Muschinski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Muschinski, Gold Investment Letter's employees and affiliates, as well as members of their families, may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

McEwen Mining—Updated Targets

I tend to write about McEwen Mining (MUX on TSE and NYSE—I will be speaking in USD price terms--$2.97 currently) every May it seems but that hasn’t been intentional. But so be it, now happens to be a great time for an update. As you can see below (I’ve posted what I wrote in May 2016 with a link to the initial buy recommendation on the blog from May 2015 if you would like to review the progression of thoughts), I initially recommended MUX at $1.09 so in 24 months the share price has tripled essentially.Last summer the price doubled within 2 months after our update and Q&A/webinar with Rob McEwen posting in May 2016. We took off our principal risk in July 2016 literally at $4.90-$5 as my alert was right at the interim top. I have recommended adding that position back on and then some each time the share price has dipped below $3. So, we own a much bigger position “on the house” now than we did last summer and I have just added even more to my position in the high $2’s. There is a chance the gold miners remain weak through the summer, which is normal, and we could have a chance to add even cheaper. But technically and fundamentally, this is where investors want to be adding to their positions.During the May 2016 video, I raised my price target to $10 by the end of 2017. I am maintaining the $10 price target but am expanding the time horizon to 18 months from now (year end 2018). I believe we’ll see MUX test last summer’s high of $5 by the end of 2017 and it may trade higher than that but I’ll be a bit more conservative on the timing as it is a very aggressive call on ROI from here. WE MUST BE IN THE HABIT OF ADDING TO BEST OF BREED GOLD MINERS WHEN THEY ARE DOWN EARLY ON IN A NEW BULL CYCLE. This is a discipline and unless you have the resolve to buy when things don’t look rosy, you will rarely make money in the market, especially in mining stocks!There is nothing wrong with MUX. This is a normal fluctuation in prices! MUX will trade with the sector and I believe will outperform it going forward due to their excellent assets and operator at the helm, Rob McEwen. Timing is everything and now I feel is a good time to revisit the webinar with Rob for a refresher or to introduce you to this quality company for the first time. One year ago in May 2015, I initiated coverage on McEwen Mining (NYSE: MUX) (TSE: MUX) at $1.09 per share with a strong buy recommendation and a 12-24 month price target of $3 (speaking in terms of USD MUX on NYSE). You can read the report here.The share price has gone up by 150% and closed today at $2.53. During my webinar below, which Rob and I recorded today, I raised my price target to $10 per share by the end of 2017. I will be walking through more solid economics in my next report but we did some back of the napkin tabulations on the webinar. Rob demonstrated that when all categories of reserves are measured, and including their copper monstrosity that is Los Azules, MUX owns 46 Million ounces of Gold equivalent ounces in the ground right now. Stick that in your pipe and smoke it! In the report from May 2015, you’ll see a 10 year chart showing 3 major bottoms and two major tops since Rob took over UXG (now MUX). The 3rd top will be hit again, and it also will likely be breached. The price has twice hit $10 per share when MUX wasn’t nearly as established. Rob McEwen has put $127 MM of his own cash in MUX to acquire his 25% equity ownership position. His only reward in building the company is share price appreciation as he takes no salary, no options, no bonuses, etc. His personal cost average is just under $2 per share. We can buy today just 20% above his cost basis but he has been busting his hump building value in the business for well over a decade, we just press the “buy” button. Enjoy the 45 minute or so webinar for yourselves. The camera didn’t zoom back and forth to who was speaking so you’ll have to look at my mug throughout! Or better yet, just turn up the volume and listen versus watch….it’s a talk/Q&A.Check out the webinar below with Rob McEwen and sign up with your name/email for updates on MUX and other unique investing ideas from GIL.

For updates on McEwen Mining and unique ideas on individual mining stocks, please sign up for our free newsletter below

Legal Disclaimer: I am offering ideas for your consideration and education. I am not offering financial advice. I am not a financial or investment advisor and am acting in the sole capacity of a newsletter writer. I am a fellow investor and trader sharing his thoughts for educational and informational purposes only. This publication is a 100% subscriber supported. No compensation is received by the author from any of the companies mentioned for the recommendation of a stock in this service (if this changes or there is exception-it will be clearly disclosed to our readers. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided on the Website is based on careful research and sources that are believed to be accurate, Mr. Muschinski does not guarantee the accuracy or thoroughness of the data or information reported. The opinions published on the Website belong to Mr. Muschinski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Muschinski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published on the Website have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Muschinski’s essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Muschinski, Gold Investment Letter’s employees and affiliates, as well as members of their families, may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Southern Silver Site Visit and Valuation Update

On January 28th, 2017 I traveled to Durango state Mexico to tour Southern Silver’s (SSV/SSVFF) Cerro Las Minitas property (CLM). Lesley Stokes from the Northern Miner was with us and she wrote up an informative article last week.I initially published a public report on SSV in May 2016 at 14 cents per share which you can read here.

[Our editor on site at drill #92]

Interestingly, if you look at the long term 10 year chart I posted back in May, I circled two target areas at that time. The first circle was around 50 cents. The share price broke above 50 back in August last year hitting a high of 66 cents but fell back and has been consolidating below 50 cents for 5 months. Guess where we have been seeing resistance recently? 47-50 cents. What is encouraging though is that on the weekly chart below, we are seeing bullish confirmations in a very recently rising MACD (bottom right) and reverse head and shoulders pattern. Technically, it is highly likely that the next move resolves itself upwards not only besting 50 cents per share but also the previous high at 66 cents.I want to note the second target area I circled almost 9 months ago when the share price was just 14 cents, which is at $3. It won’t go there overnight as the next major resistance area after besting last year’s high will be at $1. Once $1 is broken, $3 per share should actually happen a lot faster than it took for the price to get back to $1 from bear market lows. What could be the catalysts for such a surge besides rising silver/zinc prices? It could very well be the potential doubling of the resource this coming summer. The current resource at CLM is 36.5 million indicated silver equivalent ounces and 77.3 million inferred equivalent ounces containing primarily silver, zinc, and lead. The current in situ value of the resource exceeds $2.3 Billion and has grown several hundred million dollars due to zinc’s huge rise in 2016. The company is now in the midst of a 10,000 meter drill program with an ambitious goal to double the current resource. The $2MM program is being funded by the Electrum Group who is earning into 60% ownership at CLM and SSV will own 40% once the money has been spent (Electrum will have spent a total of $5MM at CLM by this June).

[Core shack]

“We already have a great deposit as it is, but once we hit the Blind Shoulder zone we just started following the high-grade, and we think we can double what we have right now,” Macdonald says during the drive to the property.The quote above is referenced from the Northern Miner article via SSV geologist Rob Macdonald. Obviously, there is no guarantee that they will double the resource but I will say that the SSV team certainly feels confident in the plan to do so. Right now at 48 cents CDN, the market cap of $40MM is valuing each silver equivalent ounce at 30 cents. I believe that is too cheap and I see many examples with silver equivalent ounces valued at $2 (Defiance Silver) or even $4 (Alexco). What is a fair value? Once SSV is in the PEA or pre-feasibility stage (we’ll see what’s next….probably a PEA but they will have to review the plan with Electrum this summer once results are known), $1.00 per equivalent ounce is very reasonable. In fact, $1 per OZ right now is reasonable.At $1 per ounce of silver equivalent resource the stock would be trading at $1.50 right now. Wonder how they get to $3? Double the resource and walla! Keep in mind that these comps are fair with a $17-$20 an ounce silver price. $25 silver and the valuation could easily double to $2 per equivalent ounce or triple at $28-30 silver, which I believe is coming. For now, I’m only looking for $1 per silver equivalent ounce of resource on what they have today which forecasts a $1.50 share price. I’ve been saying $1-2 in 2017 so I’m very comfortable with this price target.

[Cerro Las Minitas--The Hill of Many Mines]*Note the modern highway just meters from the property

One thing that should bolster investor’s confidence is the direct involvement of Tom Kaplan’s Electrum Group. This group is the smart money, make no mistake about that. Kaplan has literally made a fortune by building up plays just like Cerro Las Minitas and they will do it again….and again…and again. In this particular case I’m betting on both the horse (CLM) and the jockey’s. Larry Page via Western Silver has been involved in some monstrous successes as well such as discovering Penasquito in Mexico though Western Silver Corp. This mine now produces almost 1 million ounces of gold annually.I’m confident that in the next sustained move higher in precious metals, the gold/silver ratio will begin to tighten in silver’s favor. At 70 to 1, it is on the very high end historically and should make its way into the 30-40 to 1 area within 2-3 years, maybe even much sooner as silver can make up ground fast when it decides to! I don’t see Southern Silver taking CLM into production as they will be acquired well before then. This is an asset the majors will want and the company could be in play as early as this coming fall after the new resource estimates are on the table. The longer an acquirer waits, the higher price tag they will need to pay so I would rather see an offer in 2018 or once silver is $25 or higher, minimum.More details on mineralization and the various target zones can be read in SSV’s corporate presentation and/or in the Northern Miner article. SSV remains a buy under 50-60 cents and on pull backs. It remains my top junior silver holding. SSV was a sector leader during the huge gold/silver stock rally in 2016 and I expect it to remain an out performer in the next run.For updates on Southern Silver and unique ideas on individual mining stocks, please sign up for our free newsletter below.

Legal Disclaimer: I am offering ideas for your consideration and education. I am not offering financial advice. I am not a financial or investment advisor and am acting in the sole capacity of a newsletter writer. I am a fellow investor and trader sharing his thoughts for educational and informational purposes only. Southern silver is a paying sponsor of our website so my viewpoint may be skewed. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided on the Website is based on careful research and sources that are believed to be accurate, Mr. Muschinski does not guarantee the accuracy or thoroughness of the data or information reported. The opinions published on the Website belong to Mr. Muschinski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Muschinski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published on the Website have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Muschinski’s essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Muschinski, Gold Investment Letter’s employees and affiliates, as well as members of their families, may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.