GIL Goes Neutral on Gold; Remains Bullish on Mining Equities

Go back 24 months ago on our YouTube page to review numerous videos preparing investors for the bullish signal we had been hawking for years. That "all in" green light flashed via March 2024 when gold had its first monthly close above $2,200 per ounce as we can see clearly on the chart below:

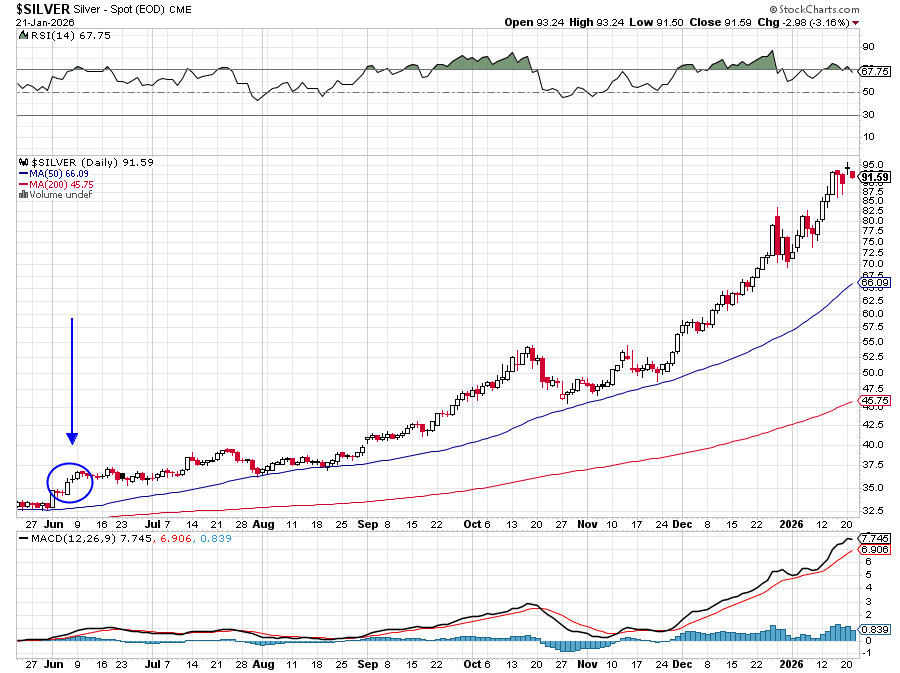

*Note the other blue circle in the upper right as gold hit's a mid 90's RSI on this monthly chart

We happened to be filming a series on Real Vision titled "Investing in the Minefield" in the lead in and immediately after the gold breakout in 2024. This page from a quick search also links a special we did called "Why Silver" in June of 2025 to pound the table on the very important $35 an ounce breakthrough.

I'm officially going neutral on the gold price, not because I'm bearish, but because the low hanging fruit on this trade is gone. My career in capital markets revolves around the ability to get AHEAD of markets, not to worry about whether we go to $5,500 gold or $3,500 gold next (it could hit both by the way) as I don't care....at all.

Over time a $10,000 plus gold price is in consideration but in my experiences being taken to the woodshed, a 95 RSI on a decade plus length technical indicator means pumping the brakes on expectations is usually wise (short to intermediate term anyways).

So, Where is the Play?

Mining Equities. Gold and silver stocks are undervalued in this environment of robustly all time high prices in the metals. Do you know what happens to cash flow when a mining business has fixed costs but the product they sell triples over 3-4 quarters (e.g. silver)? It skyrockets! And the beefy profits and balance sheets of the top gold/silver companies are going to become glaringly evident once Q4 2025 and Q1 2026 earnings start to flow on the street.

M&A is about to accelerate big time in this sector as companies NEED to fill their development pipelines by buying junior exploration-mid tier development stage companies and assets. Let's look at one example today where we have made substantial gains already, yet upside acceleration in valuation is ahead of us, not behind.

International Tower Hill Mines (THM/ITH.TO) is my largest individual gold equity holding in my portfolio now by a lot (Phenom Resources PHNMF/PHNM.V is close in value despite not increasing at all versus a 4X move in THM since coverage began in December 2024), and for good reason. I'm ASTOUNDED that this stock is not back to its 2011 highs over $10 per share USD yet! However, this means an opportunity remains and I believe it is a huge one if you think quadrupling your money sounds interesting.

When initiating coverage at all membership levels between .50-.75 per share I said my minimum target was $3 which was due to a simple top line channel metric, which has already been hit. I'm an active consultant to the company and enjoy a substantial amount of stock options exercisable just under .50 per share. Yet, on the recent move above $3, I haven't exercised a single share yet as I made this decision to roll the dice for serious net worth building (for me) by looking at that $10 area and realizing it is very realistically going there.

Why?

THM is far from overbought technically as you can see below...

2/3 of the shares are locked up by 4 noteworthy institutions in this space, Paulson and Co, Electrum Group, Sprott, and Kopernik Funds. At least 3 of these investors have been in THM for over a decade and, I believe, are in no hurry to sell now that we have the perfect storm in gold prices. Tower Hill's Livengood project in Alaska has over 13.6 million ounces of gold resource already with over 9 million ounces in the reserve category.

It's over $60 Billion of gold in the ground and the current net asset value/NPV at $4,500 gold is over $25 Billion. Check this out (!). As of today's ChatGPT search, senior gold producers are trading at an average of 1.5X NAV on average. Mid-tier producers are scattered around/just below 1X NAV. Historically in gold bull markets, senior gold companies have traded closer to 2X NAV. THM/Livengood? .02X NAV. Yes, THM would need to rise approximately 50X to get to 1X NAV. Hello? Hello?!?

THM closed at a $493 million market cap yesterday which values their large and unique gold asset at about $37 per ounce of gold in the ground. You want a bargain? Go buy stakes in companies that have gold in the ground at a 99% discount to the spot gold price. Some major institutional investors/large family offices are going to catch onto this story and the days of a $2 and even $3 handle on THM will be long gone.

Phenom Resources

PHNMF/PHNM.V is a stock that many of you own so I will have a separate more thorough update on the company. Their recent rare earth/critical minerals discovery at Crescent Valley adds another layer to what is one of the most exciting junior exploration stocks in the marketplace. Gold, vanadium, and REE's all in Nevada and a stock that has languished. However, not for much longer.

PHNM is a strong buy up to .30 CAD....stay tuned.

Join our premium service below for more junior mining stock recommendations (sorry but Elite is full).

Cheers,

Eric

___

Legal Disclaimer: I am offering ideas for your consideration and education. I am not offering financial advice. I am not a financial or investment advisor and am acting in the sole capacity of a newsletter writer. I am a fellow investor and trader sharing his thoughts for educational and informational purposes only. **As of December 2nd 2024 International Tower Hill Mines Ltd. has entered into a consulting and stock option agreement with Phenom Ventures LLC. This agreement, disclosed in an SEC filing, aims to boost the visibility of the company's Livengood Gold Project among investors. As part of the deal, Phenom will provide communication services to promote the project, and in exchange, International Tower Hill Mines will grant Phenom 2.5 million stock options priced at CAD$0.64. The stock options vest in stages, with 1 million options having vested immediately on December 2, 2024, and additional options set to vest in 2025 and 2026 based on specific performance criteria. The consulting agreement is scheduled to terminate on December 2, 2026, but may end earlier under certain conditions. Phenom is also required to safeguard the company's confidential information throughout and beyond the agreement's duration. This strategic move is part of the company's efforts to communicate the potential of its project and attract further investment. The detailed terms of the agreement are outlined in the company's SEC filing Opinions and analyses were based on data available to authors of respective essays at the time of writing. Opinions and analyses were based on data available to authors of respective essays at the time of writing Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided on the Website is based on careful research and sources that are believed to be accurate, Mr. Muschinski does not guarantee the accuracy or thoroughness of the data or information reported. The opinions published on the Website belong to Mr. Muschinski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Muschinski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published on the Website have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Muschinski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Muschinski, Gold Investment Letter's employees and affiliates, as well as members of their families, may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.